Appealing to the State Board of Equalization

With limited exception, a disputed assessment must first be appealed to the county board of equalization of where the property is located or it becomes final. Contact the assessor in your county to appeal to the county board of equalization.

Appeals to the state board of equalization from a local board of equalization must be filed on or before August 1 of the tax year, or within forty-five (45) days of the date notice of the local board action was sent, whichever is later.

File A Value Appeal

Taxpayers wishing to appeal a property's value to the State Board of Equalization should do so through our online filing system.

SBOE Public Portal

The SBOE Public Portal provides up-to-date information regarding the status of appeals before the board.

0. Informal Review by your County Assessor of Property:

Some county assessors have a process for informal review of disputed assessments which may provide expedited review and correction of any contested property valuation. However, informal review is not an appeal and taxpayers must appeal to the county board of equalization should they wish to preserve their further rights of appeal.

To inquire if your county assessor offers an informal review process, contact your county assessor’s office.

1. The County Board of Equalization: the first level of appeal

Taxpayers must typically appeal a disputed valuation or classification to the local county board of equalization or else they may be prevented from further appeal.

The county board of equalization is a panel of five or more persons empowered to hear complaints of a taxpayer and make certain changes to disputed assessments. Notice of the decision and action of the county board will be sent to the taxpayer who may accept or appeal the decision.

2. Appeal to the State Board of Equalization:

Appeal Hearing before an Administrative Judge:

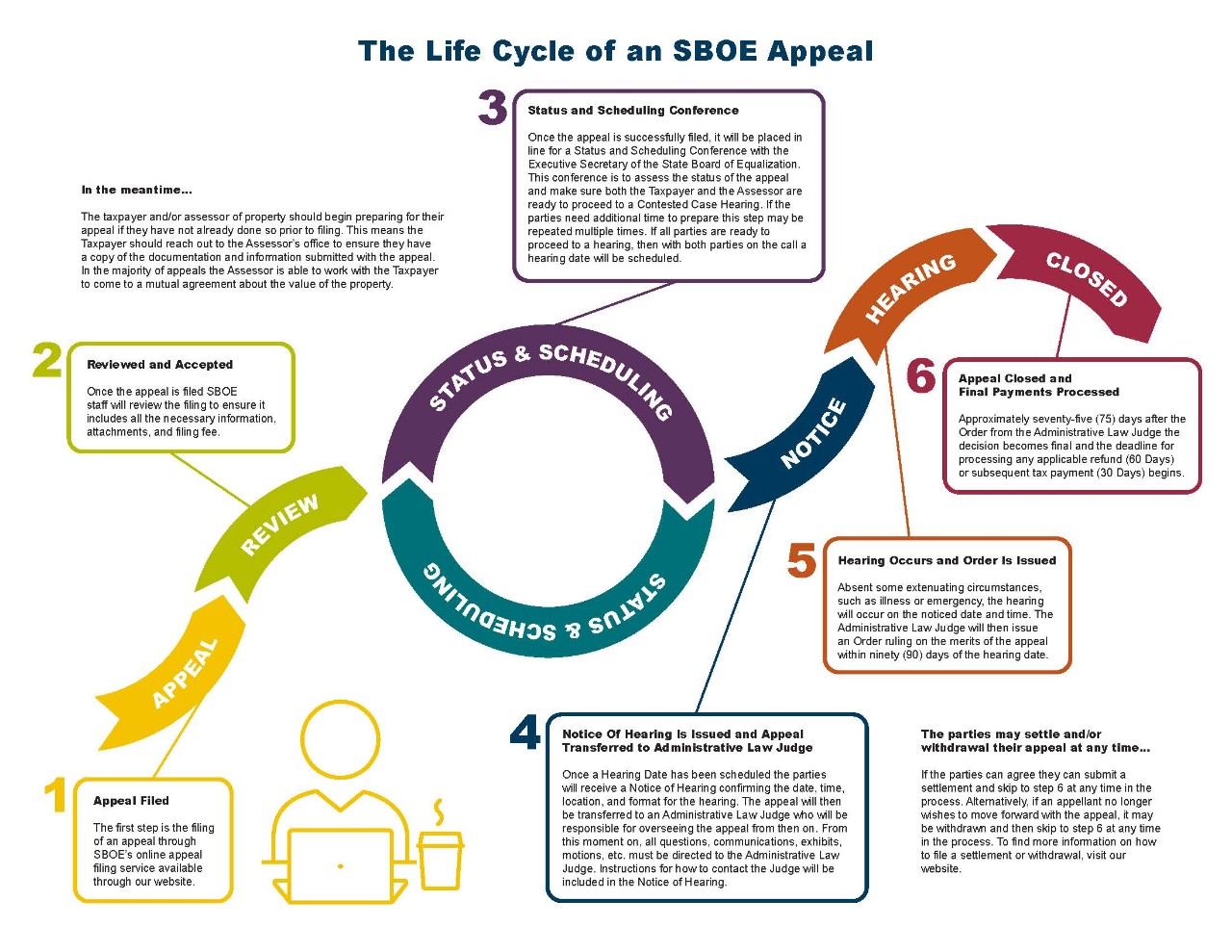

Should a taxpayer disagree with a decision of a county board of equalization, the taxpayer may appeal to the State Board of Equalization. An appeal to the State Board of Equalization first consists of a hearing where you and the county assessor's office may present relevant testimony and evidence regarding your property’s assessment.

An Initial Decision and Order regarding a taxpayer's appeal will be issued by the administrative judge within ninety (90) days of the hearing. The Initial Decision & Order of the administrative judge becomes the final decision of the State Board of Equalization if a petition for review is not filed.

The State Board of Equalization:

A party may petition the Board to review a decision of an administrative judge. Parties have thirty (30) days from the date the Initial Decision & Order was sent to file a written petition requesting a review by the Board.

A party who wants the Board to review an Initial Decision & Order must file a written petition with the Executive Secretary of the State Board of Equalization within thirty (30) days from date the order was sent. Review by the State Board of Equalization of an Initial Decision and Order is discretionary and is not guaranteed. The Board may choose to decline review entirely. The Board may also modify, reverse, or adopt the Initial Decision and Order as the final decision of the Board.

Instructions for submitting a request for review will be included with the Initial Decision and Order issued by the Administrative Procedures Division of the Secretary of State's office.

3. Chancery Court and beyond:

A taxpayer wishing for judicial review of a final action of the State Board of Equalization must file a petition in the county where the disputed assessment was made or in an appropriate chancery court within sixty (60) days from when the order of the State Board of Equalization becomes final.

How to Schedule an Appeal Hearing:

Once your appeal is filed and pending with the Tennessee State Board of Equalization, the next step is to schedule your hearing. To request a hearing date, please contact us at:

Call: 615.401.7883 (extension 2 for Scheduling)

Email: sb.web@cot.tn.gov

If You Do Not Request a Hearing Date:

If you do not request a hearing date, you may be scheduled for a Status and Scheduling Conference, or a hearing date may be selected for you. If a date is chosen for you, you will be sent a Notice of Hearing at least 60 days in advance with the details.

Once your Appeal Hearing is Scheduled:

- A Notice of Hearing will be emailed and mailed to you at least 60 days before the hearing date.

- Once the Notice of Hearing is issued, the appeal will be transferred to the Administrative Procedures Division (APD), which will assign an Administrative Judge.

- The Administrative Judge will provide the link and details for joining your hearing closer to the hearing date.

- Instructions for pre-filing exhibits or other materials will also come from the Administrative Judge.

- After the Notice of Hearing is issued, any requests to reschedule or postpone should only be made in the case of an emergency and must be made in writing to the Administrative Judge.

Administrative Procedures Division

Once your appeal hearing is scheduled, your appeal will be transferred to the Administrative Procedures Division, a division of the office of the Tennessee Secretary of State. Click above to visit their webpage.

In certain cases, an appeal filed with the State Board of Equalization (SBOE) may be transferred to the Administrative Procedures Division (APD) of the Tennessee Secretary of State’s Office. This transfer is a significant step in the appeal process.

If a formal hearing is required—either due to the complexity of the issues, a party's request for a hearing (see above for how to schedule your appeal hearing), or the need for a ruling by an independent decision-maker—it is transferred to APD. This means that the appeal will be assigned to an Administrative Judge, who will preside over the case, conduct a hearing, and issue a decision based on the evidence presented.

Appeals are transferred after a Notice of Hearing or Notice of Pre-Hearing Conference is issued. Copies of a Notice of Hearing or Notice of Pre-Hearing Conference will be sent to the parties by email and certified mail. Once the transfer is complete, APD will issue an APD Case Number, and all further communications and scheduling information will come directly from APD.

Once your appeal is assigned to APD, you will be expected to follow APD’s rules, deadlines, and procedures. This includes how and where you file documents, attend hearings, request settlements, and communicate with the judge. Failing to follow APD instructions may result in delays or dismissal of your case.

If you are unsure whether your appeal has been transferred to APD, check for:

- A Notice of Hearing or Pre-Hearing Conference

- An APD Case Number

- Direct emails or letters from APD staff

You can find the contact and filing information for the Administrative Procedures Division on their webpage.

In order to support a change to the assessment adopted by the County Board of Equalization, you must show, by a preponderance of the evidence, what the correct assessment of the property should be. It is up to you as the person seeking to change the current assessment to carry the burden of proof to support a change.

The Administrative Judge does not independently investigate the property or develop evidence on behalf of either party. The decision will be based solely on the evidence presented during the state appeal proceeding.

Supporting documentation may be submitted at the time an appeal is filed. Additional evidence may be submitted prior to the evidentiary hearing in accordance with instructions provided by the Administrative Judge assigned to your appeal.

- Evidence submitted to the County Board of Equalization is not automatically included in the record before the Administrative Judge. If you wish for evidence to be considered at the state level, you must submit it in accordance with the instructions provided by the Administrative Jude assigned to your appeal.

- An increase in value of a property under appeal following a county-wide reappraisal–without more–neither invalidates the assessment nor justifies a basis for changing the assessment. The Administrative Judge may, within his or her discretion, disregard the increase as an indicator that the assessment is incorrect.

- Statements that a property is overvalued, without supporting evidence establishing a more correct value or the amount of any requested reduction, are generally insufficient to support a change in assessment.

- If evidence (photos, documents, testimony, etc) submitted fails to quantify the impact on the value of the property, the Administrative Judge, within his or her discretion, is not required to independently discern and attribute value to evidence presented by any Party.

- The best evidence of value for residential property is generally sales of properties comparable to the property under appeal (comparable in features relevant to value). Perfect comparability is not required, but relevant differences should be explained and accounted for by reasonable adjustments. For example: differences in acreage or square footage (size); condition, age, or date built; location; features; date of sale; time on market; number of rooms; or other factors impacting value. If evidence of a sale is presented without an analysis of comparability, the Administrative Judge may, within his or her discretion, disregard the sale as an indicator of value.

- While not required, an appraisal by an appraiser generally may be presented as evidence. If an appraisal is submitted, the appraiser may be required to testify regarding the appraisal.

Visit our rules of the board, to review what rules apply to Appeal Hearings before the board.

Every hearing is presided over by an Administrative Judge from the Administrative Procedures Division (APD) of the Secretary of State’s Office. The judge leads the hearing, ensures all parties have a chance to present their case, and issues a decision based on the evidence and testimony provided.

A representative from the county assessor’s office is also expected to attend, as they are a party to nearly all assessment appeals. You, as the taxpayer, may attend alone or choose to bring a representative, such as an attorney or authorized agent. You may also invite witnesses or others to support your appeal, including appraisers or anyone whose knowledge of the property that may be helpful to your case.

Your Administrative Judge will provide details for how to join a virtual hearing and instructions for how to identify any witnesses you intend to bring.

The State Board of Equalization is tasked with reviewing assessments and decisions made by local boards of equalization. Any taxpayer or any owner of property subject to taxation in the state, who is aggrieved by any action taken by the county board of equalization has the right to appeal to the State Board of Equalization. A taxpayer or owner of property must first make a complaint and appeal to the local board of equalization unless an exception provided by law allows otherwise.

Direct appeals to the State Board of Equalization without first appealing to the county board of equalization are allowable if:

- The taxpayer or owner has not been duly notified by the assessor of property of an increase in the taxpayer's or owner's assessment or change in classification as provided for in Tenn. Code Ann. § 67-5-508.

- Notice of an assessment or classification change pursuant to Tenn. Code Ann. § 67-5-508 was sent to the taxpayer's last known address later than ten (10) days before the adjournment of the local board of equalization.

- The taxpayer can show reasonable cause, meaning circumstances beyond the taxpayer's control, for the taxpayer's failure to first appeal to the county board of equalization.

- The taxpayer is appealing a correction made by or refused by the county assessor.

- The local assessor has given written consent for the taxpayer to appeal Industrial & Commercial classified property directly to the State Board of Equalization, as provided for in Tenn. Code Ann § 67-5-1412(b).

The State Board of Equalization does not have jurisdiction to accept an appeal from a taxpayer after March 1 of the year subsequent to when the time for appeal to the state board began to run.

The law requires that you pay at least the undisputed portion of your taxes prior to the delinquency date to avoid penalties and interest. You also must pay the full amount of any delinquent taxes due against the property for prior years. See Tenn. Code Ann. § 67-5-1512(b). By so doing, you avoid the usual penalty and interest for delinquent taxes and the possible delay or dismissal of your appeal. When a final certificate of assessment is issued by the State Board of Equalization, the taxpayer will owe the amount of any underpayment of taxes, along with interest at the rate provided by law.

To calculate the undisputed portion of taxes, subtract the value you claim in good faith to be the fair market value for your property, from the assessor’s value, and multiply the result times the applicable tax rate. For more information about calculating your taxes owed see "How to Calculate Your Tax Bill." County taxes for the year under appeal may be obtained from the office of county trustee. City taxes (if any) may be obtained from the city collecting official, who may be either the city treasurer, city recorder, or the county trustee, who sometimes also serves as the city tax collector.

The interest rate applicable to taxes under appeal is the composite prime rate published by the Federal Reserve Board, minus two points. (available below).

Decisions of an administrative judge or the State Board of Equalization are only final once further opportunity for agency review has concluded. The time period for further review differs depending on what level the appeal is. If no party appeals a decision, the typical periods are as follows:

- Initial Decisions and Orders of an administrative judge are typically final thirty (30) days from the date of the signed order.

- Orders of the State Board of Equalization are typically final as of the date they are issued.

Once a decision becomes final, the parties will receive an e-mailed notice from the State Board of Equalization and the results will be available on the SBOE Public Portal. Additionally, any delinquency penalty and interest postponed during the pendency of an appeal shall begin to accrue thirty (30) days after any decision becomes final.

Public Chapter 691 of 2014 abolished routine issuance of paper "official certificates" of SBOE action in appeals. Instead the Board will post actions via the SBOE Public Portal and send e-mail notifications to taxpayers, assessors and trustees as new postings occur effective July 1, 2014. Therefore, please provide this office with and maintain an updated email address for this purpose. This means significant savings in mailing and handling costs, but also may change how you close records of appeals.

Assessors may continue to certify appeal revisions to their collecting officials if this is your present practice, as a means of assuring the collector has an accurate basis to refund or collect tax due following the appeal. Collectors who have used the State Board certificates as the sole basis for further refund or collection may use the posted State Board actions instead, perhaps allowing a routine lag time to allow the assessor to review the postings for error. If you detect an error in a posting, send your correction request to Shirley.Marriott@cot.tn.gov for counties beginning with A - R and Rhonda.Wright@cot.tn.gov for counties beginning with S - Z and include the following information:

· Record

· Number

· County Name

· Tax Year

· Correction Description

· Business or Appellant Name (under which the original application was filed)

· Final Result Date

Please call (615) 401-7883 if you need additional assistance.

The appeal process for Tennessee’s property assessments may result in a taxpayer having to file an appeal on the same property for several tax years, with each year at different points in the assessment process. To alleviate duplicate appeals that may result in multiple hearings using the same evidence, the Tennessee State Board of Equalization permits the consolidation and amendment of a real property appeal to encompass subsequent tax years up through an entire reappraisal cycle.

To learn more about the amendment process and subsequent tax years, see our memo regarding Subsequent Tax Years and Amending Appeals by clicking the link below:

While an appeal is pending the parties (usually the Taxpayer and County Assessor) may agree to settle a matter before the board. Parties who wish to settle a disputed assessment should submit an Order of Compromise and Settlement in which they stipulate the assessment for the property under appeal.

By submitting a settlement, the parties do not have to go through a hearing and they forgo any further appeal or reconsideration process.

An Order of Compromise and Settlement becomes the final action of the State Board of Equalization once it is signed and sent to the parties. A copy of the results in the form of an Official Certificate will be issued pursuant to Tenn. Code Ann. § 67-5-1512, enabling the appropriate collecting official to process any applicable payment or refund of taxes due.

See below for settlement templates and instructions for how and where to file your agreement.

If your appeal has not yet been transferred to the Administrative Procedures Division (APD), please submit any signed settlement agreements to:

Include your SBOE Appeal Number and contact information in the email. If you have questions about your case status, feel free to reach out to our team using the email above.

If a Notice of Hearing or Notice of Pre-Hearing Conference has been issued, your appeal has been transferred to the Administrative Procedures Division (APD) and you must submit your settlement agreement directly to APD. Appeals that have been transferred will include an APD Case Number and you will receive direct communication from APD, including a notice of docket, scheduling information, and filing instructions.

If you're unsure whether your appeal has been transferred, look for:

- A Notice of Hearing or Pre-Hearing Conference from APD

- An APD Case Number in your correspondence

- Additional emails or letters directly from the Secretary of State's Office

You can find APD’s filing procedures on their website:

A taxpayer may request to withdraw an appeal before a decision has been entered on the primary issue of the complaint and appeal. A taxpayer who withdrawals their appeal, also waives their right to further appeal or for reconsideration.

When the taxpayer submits a withdrawal request, the Board will issue an Order of Dismissal, which becomes the final action of the State Board of Equalization. After the action has become final an Official Certificate will be issued pursuant to Tenn. Code Ann. § 67-5-1512, enabling the appropriate collecting official to process any applicable payment.

See below for withdrawal templates and instructions for how and where to file your notice of withdrawal.

If your appeal has not yet been transferred to the Administrative Procedures Division (APD), please submit any withdrawals to:

sb.web@cot.tn.gov

Include your SBOE Appeal Number and contact information in the email. If you have questions about your case status, feel free to reach out to our team using the email above.

If a Notice of Hearing or Notice of Pre-Hearing Conference has been issued, your appeal has been transferred to the Administrative Procedures Division (APD) and you must submit your withdrawal directly to APD. Appeals that have been transferred will include an APD Case Number and you will receive direct communication from APD, including a notice of docket, scheduling information, and filing instructions.

If you're unsure whether your appeal has been transferred, look for:

- A Notice of Hearing or Pre-Hearing Conference from APD

- An APD Case Number in your correspondence

- Additional emails or letters directly from the Secretary of State's Office

You can find APD’s filing procedures on their website: