Forms Approved by the State Board of Equalization

The State Board of Equalization is responsible for the review and approval of certain forms related to property assessments and valuation. Below are the forms currently approved by the State Board of Equalziation.

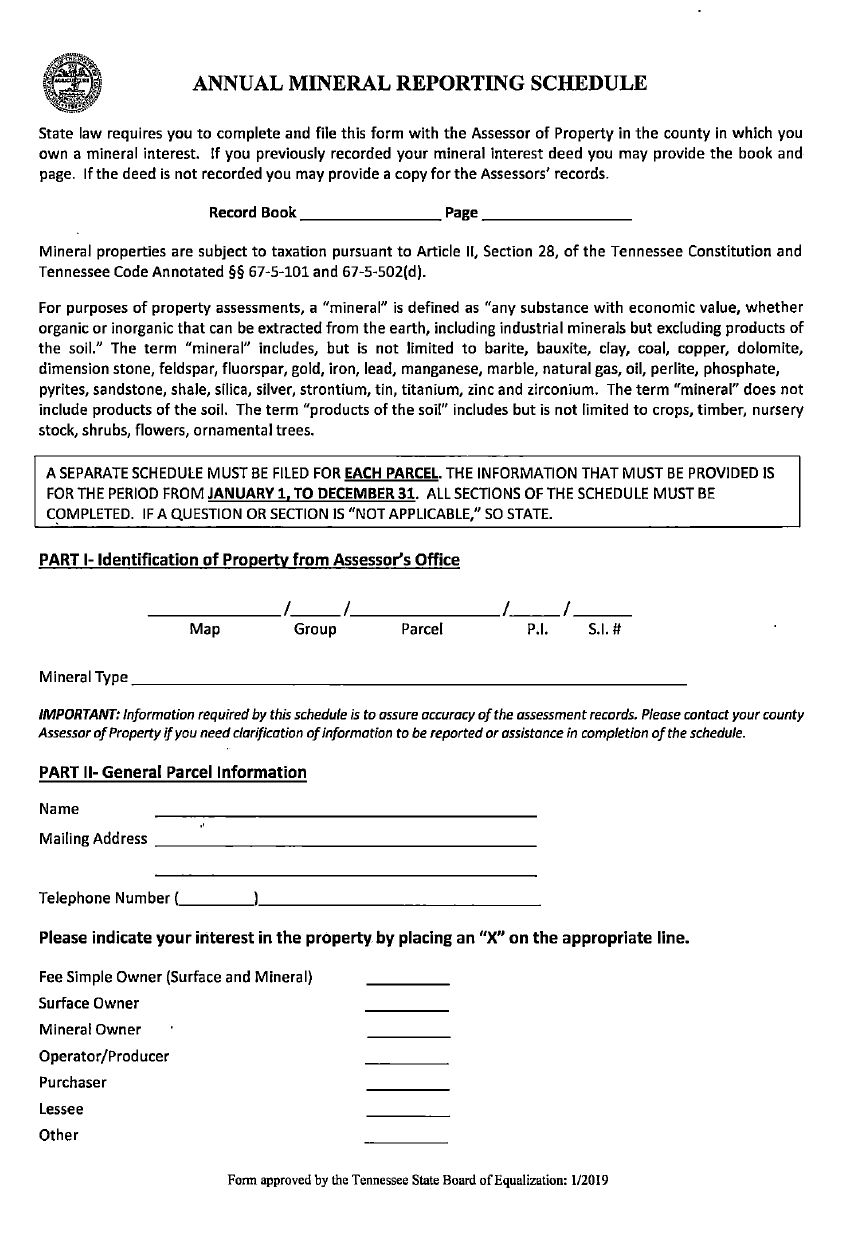

Mineral properties are subject to taxation pursuant to Article II, Section 28, of the Tennessee Constitution and Tennessee Code Annotated §§ 67-5-101 and 67-5-502(d).

For purposes of property assessments, a “mineral” is defined as “any substance with economic value, whether organic or inorganic that can be extracted form the earth, including industrial minerals but excluding products of the soil.” The term “mineral” includes, but is not limited to barite, bauxite, clay, coal, copper, dolomite, dimension stone, feldspar fluorspar, gold, iron, lead manganese, marble, natural gas, oil, perlite, phosphate, pyrites, sandstone, shale, silica, silver, strontium, tin, titanium, zinc and zirconium. The term “mineral” does not include products of the soil. The term “products of the soil” includes but is not limited to crops, timber, nursery, stock, shrubs, flowers, ornamental trees.

State law requires owners of mineral properties to complete and file the below form with the Assessor of Property in the county in which you own a mineral interest.

The president or chief financial officer of insurance companies with their principal office in Tennessee must fill out this schedule and return it to the assessor of property for the county in which the principal office of the company is maintained. An assessment schedule filed shall be derived from, and be consistent with, the annual statement of such company as of the last day of the preceding calendar year as filed with the commissioner of commerce and insurance.

To obtain a current copy of the form, please email dpa.taskcenter@cot.tn.gov.

As required by Tenn. Code Ann. § 67-5-806(b), the assessor must annually file a copy or reproduction of property maps, as currently revised, with the county register of deeds, except in counties with a metropolitan form of government, who shall, without charge, accept, file, and preserve such copy or reproduction as a public record. Filed on or before April 15 of each year, these maps reflect the status of property as of January 1 of the relevant tax year. The Comptroller's office helps supervise the preparation, maintenance, revision and recording of these property maps and uses this form to certify fulfillment of this statutory requirement.

To obtain a current copy of the form, please email dpa.taskcenter@cot.tn.gov.

In 1976, the Tennessee General Assembly enacted the Agricultural, Forest and Open Space Land Act of 1976. The purpose of the Act is to help preserve agricultural, forest, and open space land. This is accomplished by valuing land based upon its present use, rather than at a highest and best use. When property is valued at its highest and best use, the threat of development can bring about land use conflicts, create high costs for public services, contribute to increased energy usage, and stimulate land speculation.

You can find additional information and all of these forms on our Greenbelt Page.