Property Tax Freeze

Background

In November 2006, Tennessee voters approved an amendment to Article II, Section 28 of the Tennessee Constitution giving the General Assembly the authority by general law to authorize counties and/or municipalities to implement a local option property tax freeze for taxpayers 65 years of age or older.

In its 2007 session, the 105th General Assembly enacted the Property Tax Freeze Act which establishes the tax freeze and authorizes the legislative body of any county and/or municipality to adopt the property tax freeze program. The Act became effective on July 1, 2007.

Provisions

Homeowners qualifying for the program will have the property taxes on their principal residence frozen at a base tax amount, which is the amount of taxes owed in the year they first qualify for the program. Thereafter, as long as the owner continues to qualify for the program, the amount of property taxes owed for that property generally will not change, even if there is a property tax rate increase or county-wide reappraisal.

In order to qualify, the homeowner must file an application annually and must:

- Own their principal place of residence in a participating county and/or city

- Be 65 years of age or older by the end of the year in which the application is filed

- Have an income from all sources that does not exceed the county income limit established for that tax year

In counties or municipalities participating in the Tax Freeze Program, an application may be made annually to the County Trustee or city collecting official. Click here to locate a County Trustee or here to locate a city collecting official.

The state Comptroller's Office will calculate the income limit for each county annually using a formula outlined in state law.

Situations, where the base tax amount would change for a homeowner, are:

- When improvements are made to the property resulting in an increase in its value

- When the homeowner sells their home and purchases another residence

The tax freeze is available only on the principal place of residence of the qualifying homeowner located in a participating county or city.

Participating Jurisdictions and Income Limits

State Board of Equalization Rules

Frequently Asked Questions

Income Limits

Local Option Income Limits

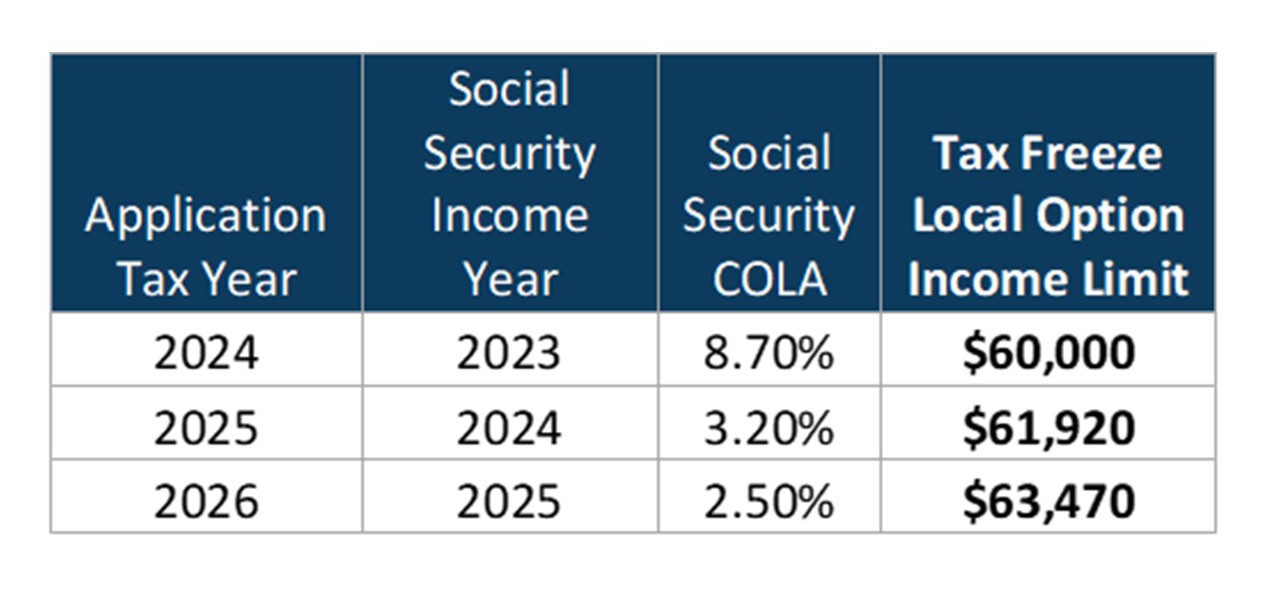

Legislation enacted in 2023 by the 113th General Assembly authorizes a local option Tax Freeze income limit as an alternative to the standard limits produced annually. The higher local option limit takes effect for the tax year following adoption by the local legislative body. First available for tax year 2024, a local option income limit of $60,000 was set in the statute. As with the income limits calculated using the standard methodology, the local option income limit is adjusted in subsequent years by the annual cost-of-living adjustment (COLA) for Social Security recipients. Below is a list of local option income limits for each tax year calculated so far.

This law introduces the possibility that a municipality and its corresponding county may have different income limits. However, instances where a municipality would be required to adopt this higher income limit are if…

- A municipality adopts the Tax Freeze and is located in a Tax Freeze county that has already adopted the local option income limit

- A municipality either adopts or has adopted the Tax Freeze and the county trustee is either accepting Tax Freeze applications or acting as the collecting official on behalf of the municipality, and the county has adopted the local option income limit

Note: Local option income limits that have been reported to the Division of Property Assessments are included in the information on this site.

Applications can be obtained from your local county trustee's office and city collecting official's office.